Why data should dictate your agenda

When we work with financial services clients, we often find that customer-facing solutions are already leveraging the latest technologies and behavioural insights – but that the way that firms are actually running their delivery portfolios needs updating.

Data-Driven Portfolio Management (DDPM) is an important way of responding to this challenge. And it is important not to oversimplify the approach as new technology alone will not allow businesses to overcome their portfolio management challenges. It requires a combination of people, process and technology to modernise Portfolio Management.

Before investing in new technology, it’s important for organisations to really understand the reasons why they should pursue DDPM.

To do that, we need to look into the exciting issues that affect modern Portfolio Managers.

The problem with traditional portfolio management

Here at Mudano, we work with lots of financial services clients who are struggling with using data to run their change management projects. The challenges are (almost) endless.

Your view of the portfolio may be fragmented, with decision-makers unable to visualise the wider picture. Projects may be running on legacy change management toolsets. Data might not always be available, accurate, or up to date, and this can lead to ineffective collaboration and decision making. In some cases, this can boil over into frustration and even confrontation.

Ultimately, all of these issues lead to a lack of visibility (and crucially, perspective) across the wider portfolio, making effective decision making at best, challenging, at worst, impossible. Portfolio management becomes backward looking, with everyone focused on understanding what has gone wrong, rather than using data to proactively anticipate issues.

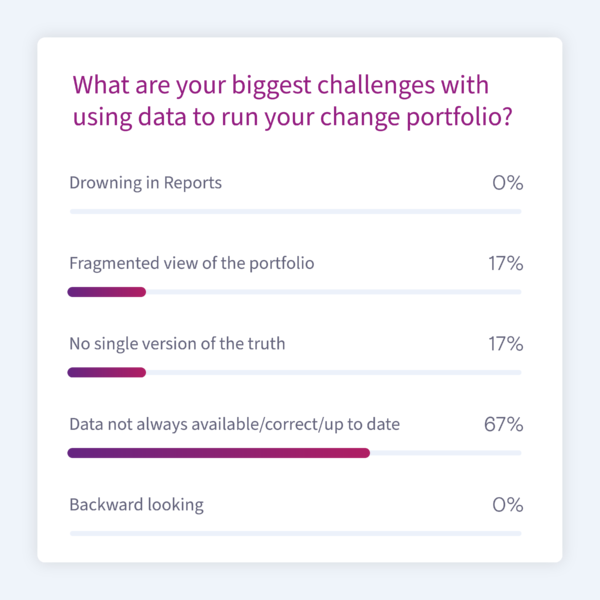

We can see from the responses during a poll held during a recent webinar on Data-Driven Portfolio Management that there are a variety of challenges that affect or block users from effectively running their change portfolios with data quality a clear frontrunner in terms of the biggest challenge that organisations face.

The common challenges that Financial Services Organisations face when managing their portfolios

What good portfolio management looks like

Of course, it’s easy to problematise existing processes and criticise the status quo. What’s harder is actually proposing practical solutions. Before doing so, it’s worth taking a step back to consider what good portfolio management should look like.

No company is perfect, and no approach to Data Management is perfect, either. But organisations doing it right share some salient characteristics:

- A Data Culture in which data is treated as an asset, that is trusted at all levels and used to back up decisions, promoting transparency and accountability.

- A clear and consistent Data Lineage framework to promote data sharing across the organisation, enabling people to spot links, dependencies, risks and opportunities, and break down complex problems.

- Performance that is transparent, elucidated by data that’s consistent, democratised and easy to access, enabling all elements of the portfolio to be accessed in one place across delivery methodologies.

Of course, this is a best-case scenario, one in which data dictates the company’s agenda and leads to operational excellence. No organisation can be expected to implement such a change overnight – but it is possible to begin improving your approach incrementally and work towards becoming a fully data-driven organisation.

How to implement a data-driven approach

In practice, becoming data-led requires a holistic approach. It’s not just about technology and analytics, it’s also about people.

To succeed, we strongly believe that organisations need to structure their change initiatives around a triumvirate of people, technology and analytics. Here at Mudano, we use a couple of key tools to achieve this.

- Our Delivery Hub consolidates and visualises portfolio data across delivery, outcomes, finance, resources and customer. We focus the pieces of information we show in interactive dashboards based on the key business questions and by doing so improve decision making and optimise investment. Ultimately, it’s about instilling better behaviours – getting away from copy-pasting into Excel and PowerPoint and building towards a deep-rooted data culture.

- Obeya is a digital collaboration space where teams collectively interpret interactive visual representations of data utilising a defined process flow to make decisions and solve problems. This helps change the way your people work by breaking down barriers between individuals and teams. It accelerates decision making by providing access to intuitive, comprehensible and unambiguous visual representations of a consolidated version of data.

Next steps

At first glance, the transition towards a data-driven approach can seem overwhelming. Ways of working can be hard to change, and passivity, negativity and resistance are all common obstacles.

But the point is to start somewhere, getting practices and processes in place, iterating and building as your internal data and portfolio-landscape matures. These insights can be built into a long-term view of data strategy. Yes, there are many moving parts, but they can come together with clear direction and an agile process. By implementing suggestions sooner rather than later, you can start to generate value for the long-term.